YEAR-END FORECAST: 8200

Quality > Junk

Large caps > Small and Micro caps

Disclaimer: at end.

Forecast

Exhibit 1 reveals the six-monthly high-low chart for the S&P/ASX 200, Australia’s benchmark share market index. A high-low chart plots the highs and lows of the period in the order that they occur.

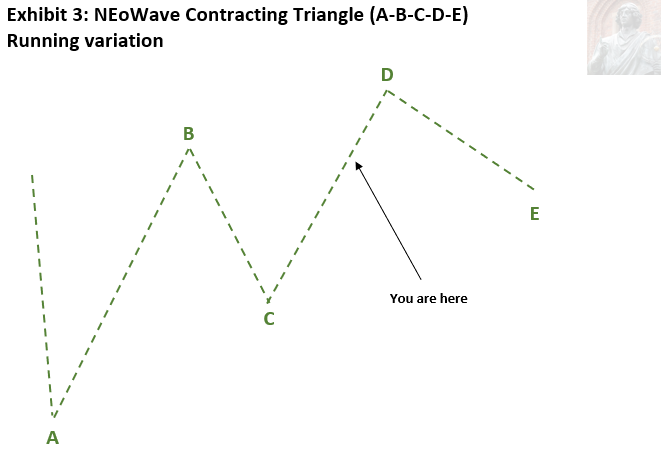

Wave Structure is consistent with a NEoWave Contracting Triangle (running variation) commencing in March 2020. Exhibit 3 below reveals more information about this price pattern.

There is sufficient evidence to confirm the likelihood that 20WD, Wave-D of the corrective price pattern that commenced in 2020, is currently underway.

The minimum move for 20WD is likely 8200 points, while Price Behaviour indicates that it could go as high as 8500 to 8700 this year. 20WD is likely to finish between September and December.

After this multi-year top, the market will move sideways with a downward bias for 1-2 years, starting with a sharp 5 to 10% decline.

Unless evidence to the contrary emerges, this is the broad framework to work within. There will be moderate to significant upside for most of this year, offset by a reasonable decline towards the end of the year. Balancing all the probable scenarios from the viewpoint of Wave Structure, the year-end target is set at 8200 points.

Even though my forecast calls for much higher prices throughout 2024, it would be imprudent to call this a bull market.

While the anticipated rise would fulfil the conventional criteria of an increase of 20% or more in a broad market index from a recent low, it may not meet the other conditions that are implied by the term.

A true bull market is characterised by optimism and requires broad investor and stock participation, not just a sustained rise in the benchmark market index. If more than half of all investors are uninterested or most stocks are heading in the wrong direction, claims of a bull market are not justified.

Index Leadership involves comparing the different capitalisation indices to determine just how strong the appetite for risk is. In the early to middle stages of a genuine bull market, micro and small caps, which are more sensitive to economic and liquidity considerations, should lead the market advance, with mid and large caps following.

Exhibit 2 compares the different Australian capitalisation indices as of the close of 2023 with respect to how far they finished from their respective 52-week highs.

Large caps stocks were essentially at all-time highs. Micro caps were well off their respective highs.

The message from Index Leadership is consistent with what is being implied by Wave Structure. While the ASX 200 will likely be much higher in 2024, it will be driven primarily by large cap stocks that have a disproportionate influence on the direction of this index. The rest of the market will likely sit on the sidelines, and perhaps even move lower. Prognostications of a bull market will, therefore, give investors a false sense of hope.

It still makes sense to be fully invested, but you must be very discerning in what you own. For 2024, I predict that quality as a factor will outperform junk, and that large caps will outperform micro and small caps.

In the wake

The ASX 200 finished 2023 at 7590.8 points, up 552.1 points or 7.8% for the year.

In early 2023, I delineated a year-end price target of 8150 points based on Wave Structure, Price Behaviour, negative sentiment, increasing risk appetite, and seasonality.

The directional call was correct, but the market finished much lower than I had forecast. The major flaw in my analysis was the assumption that 20WC, Wave-C of the corrective price pattern that commenced in 2020, had completed at the July 2022 low. It was a reasonable assumption when the forecast was made but was invalidated by subsequent price action. 20WC would continue to unfold for most of 2023 in a largely sideways direction.

As of the close of 2023, there is sufficient evidence to confirm the likelihood that 20WC completed on 30 October at 6751 points on the six-monthly high-low charts.

The NEoWave Contracting Triangle is a corrective price pattern that consists of five waves. It includes three trending waves (A, C, & E) and two countertrend waves (B & D). Each successive trending wave is smaller than the preceding trending wave, which is why it is called "contracting."

The “running” variation of a Contracting Triangle is rare. Both countertrend rallies are more substantial than the trending wave that they follow. Although they are larger in price, they move at a slower rate, which is why they are considered countertrend in nature. As a result, the correction happens "on the run". This pattern indicates a very strong (or weak if this price pattern occurs during a downtrend) market, and you can expect a significant move after the completion of the running Contracting Triangle.

Disclaimer

This market letter was prepared by Daniel Goulding and represents the views and opinions of the author. It does not constitute investment advice. My work is didactic, increasing readers’ awareness of an alternative philosophy of financial markets. I write generally and cannot determine whether an investment is appropriate for your particular needs, individual circumstances or risk profile. You should consult a financial adviser if you require professional assistance with your portfolio. I am not licenced or affiliated with any licensee. Therefore, I am free to speak my mind.

Lexicon

Composite Advance-Decline Line (A-D Line): the cumulative total of the number of advancing issues (stocks that closed higher) less the number of declining issues (stocks that closed lower) each day. The A-D Line is the classic measure of market breadth – a term that describes how many stocks are participating in a market trend. When the majority of stocks are moving higher, this is reflected in a rising A-D Line. A declining A-D Line, on the other hand, indicates that the majority of stocks are moving lower.

Corrective price pattern: A reaction against the prevailing trend of one larger degree. Overlapping is a common feature although it is not a strict prerequisite. Corrections are an outgrowth of indecision or ambiguity with respect to the future. They are labelled alphabetically (A-B-C etc).

Elliott Wave Principle: the idea that market behaviour is self-affine in nature due to recurrent oscillations in public opinion across different but simultaneous timeframes. It posits that price action can be defined, quantified and classified, and used to project the future evolution of price.

Impulsive price pattern: A fast-moving market. Impulse waves produce a significant change in the price level. A distinctive feature is minimal or no overlapping, depicting a strong level of conviction about the outlook. They contain five segments labelled numerically (waves 1-2-3-4-5).

Last Hour Index: the cumulative measure of the net change in a share market index during the last hour of trade. The idea behind this indicator is that large market participants are most active in the last hour of trading when liquidity is at its zenith, as well as being the final opportunity for them to open or close positions ahead of the close of trade.

NEoWave: Neely Extensions of Elliott Wave. The body of knowledge enunciated by Glenn Neely, represents a significant break or extension of the original theory postulated by Ralph Elliott.

Price behaviour: the quantitative assessment of price action. Essentially, the largest, fastest moves are always in the direction of the prevailing psychological trend.

Wave structure: the quantitative relationship between different waves of price action.

Transmission time:

Sydney: 07-Jan-2024 00:01

Ljubljana: 06-Jan-2024 14:01

London: 06-Jan-2024 13:01

New York: 06-Jan-2024 09:01

Good assesment in my view. I feel Neo has much more chance of picking up the price path

The high / low data your feeding into Excel, is that pre packaged for sale somewhere or do you do it all manually ?