Disclaimer: This market letter represents the views and opinions of the author. It does not constitute investment advice. It is my online journal to share knowledge of an alternative philosophy of financial markets and how I use this philosophy to trade. You should consult a financial adviser if you require professional assistance with your portfolio. I am not a financial adviser.

Summary

It remains likely that the ASX 200 will approach and probably breach the recent low of 7169 points.

A bear market has commenced. The decline will likely be around 24% or slightly longer from peak to trough. The approximate target is circa 6550 points. While the price pattern will likely be at least 2.5 years, the actual trough will occur in the next few months.

A new secular bull market will commence sometime in 2H 2027 (from a higher low). A secular bull market is a significant multi-decade advance. Wave Structure suggests it will be the greatest bull market in the history of Australian equities.

In the wake

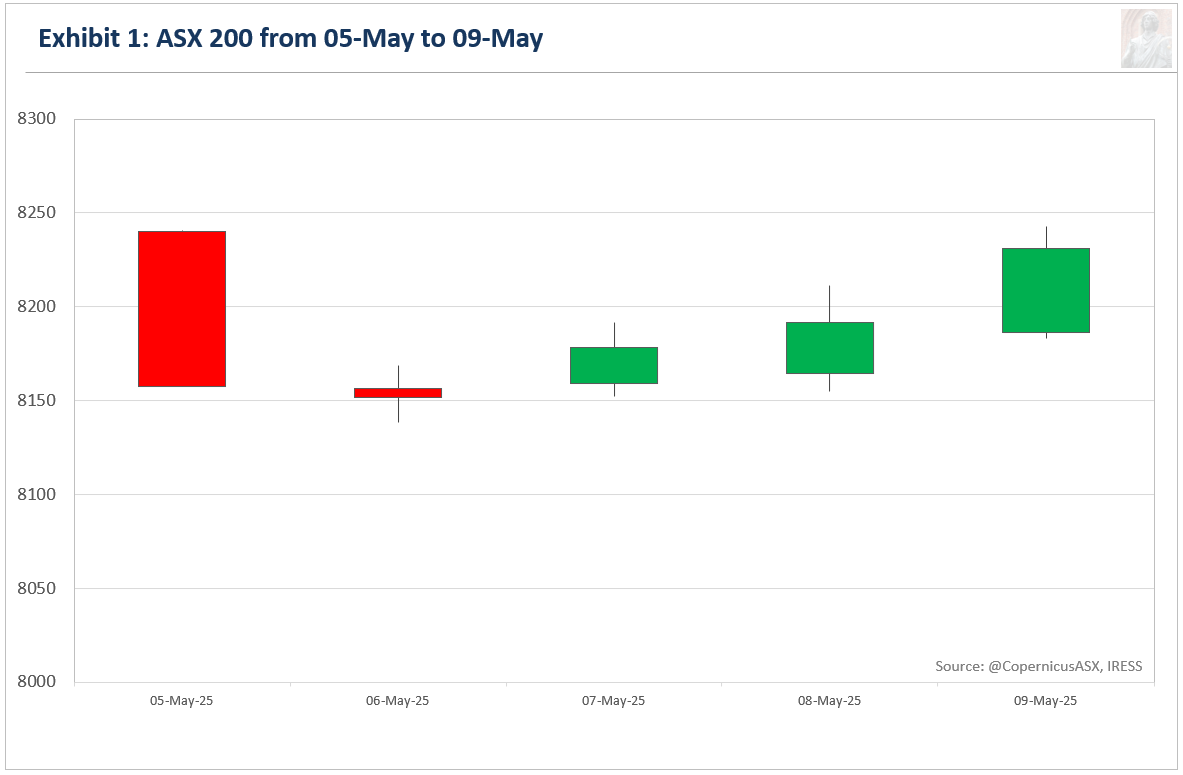

Australia's benchmark share market index, the S&P/ASX 200 (ASX 200), closed at 8231.2 points, losing 6.8 points or 0.1% for the week.

Exhibit 1 illustrates the price movement for the ASX 200 during the past week.

Last week, I wrote:

The next trending move to the downside should start this week or next.

So long as a trending wave to the downside commences shortly, the prevailing interpretation remains the best description of recent price action.

Forecast

Exhibit 2 depicts the prevailing interpretation of Wave Structure on the daily high-low chart for the ASX 200.1

The forecast has been marginally revised since last week.

The best description of price action since early February is a NEoWave Diametric, a corrective price pattern comprising seven waves, labelled alphabetically (A-B-C-D-E-F-G).

Diametrics have two key characteristics: first, they exhibit expansion during the first four waves and then contraction, or the reverse. Second, five of the seven waves are very similar in duration and complexity. Appendix One provides a deep dive into this price pattern.

While I don't have a strong level of conviction in this interpretation, it is the only one that makes sense. Furthermore, it's wise to assume you are in the middle of some price pattern when things are unclear. From this perspective, the Diametric is the best candidate. Last but not least, it is impossible to count any price pattern as complete at the low.

According to the above interpretation, waves (a) and (d) are comparable in time, with durations of 19 and 22 trading days, respectively. Meanwhile, waves (b) and (c) are also similar in time, lasting 10.5 and 8 trading days, respectively. Waves (e) through (g) will be similar in duration to one of these two pairs, probably (a) and (d).2 It is important that the ASX 200 commence a trending wave to the downside soon for this interpretation to remain a valid interpretation.

It is likely that (e) and (g) will be somewhat similar in price, but it is not possible to forecast their magnitude at this stage.

It is likely that (f) will approximate (b) in price.

The price action over the next two to four weeks will go a long way towards reinforcing the above thesis and offer insights into the magnitude and duration of the final two waves of the price pattern.

Given the size of (d), I am revising the target range to 6,550 to 7,000 points, with the low likely occurring in July.

The risk-reward profile is heavily skewed to the downside over the next nine to ten weeks. Upside risk is minimal.

Regarding long-term Wave Structure, the Diametric, labelled 25WA in its entirety3, is likely the first wave of a NEoWave Flat. Appendix Two provides a deep dive into this price pattern.

Given indications of a secular (multi-decade) bull market commencing sometime later this decade, it is highly likely that 25WA will be the low of the price pattern, with the conclusion, 25WC to conclude at a higher low.

In between these two trending waves, there will be a countertrend wave labelled 25WB. It is expected to approach or potentially exceed the all-time high within the next 12 to 18 months.

Smart money

Exhibit 3 compares the ASX 200 with the Last Hour Index using the Equal-Weight ASX 200 for its calculations.4

The premise behind this indicator is that professionals with deep pockets are most active during the final hour of trading when liquidity reaches its zenith. This interval also marks the final chance to initiate or liquidate positions within regular trading hours. Therefore, the Last Hour Index offers an alternative view of risk appetite, with turning points in this indicator typically preceding turning points in the benchmark index.

Deep pockets (smart money) remain happy to distribute stock into the market rally.

Market Internals

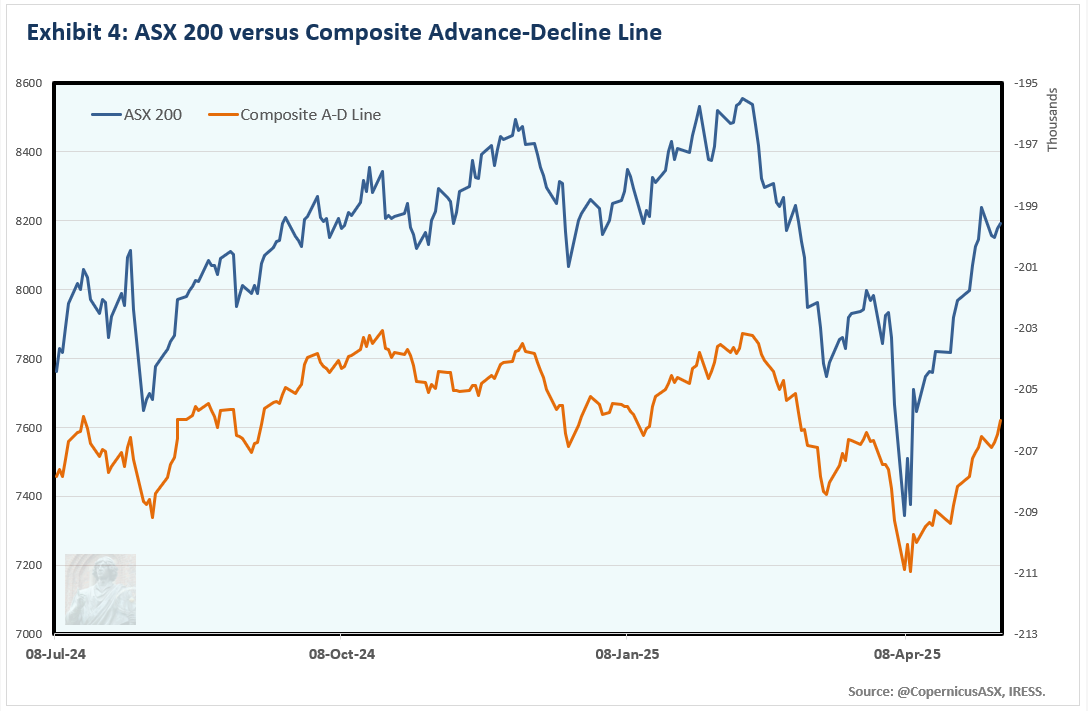

Exhibit 4 compares the ASX 200 with the Composite Advance-Decline Line (A-D Line).

The A-D Line is a representation of the cumulative total of the number of advancing issues (stocks that closed higher) minus the number of declining issues (stocks that closed lower) each day. When most stocks are moving higher, the A-D Line rises. Conversely, a declining A-D Line indicates that most stocks are moving lower. It provides a strong indication of the health of a market trend. The greater the participation of stocks, the greater the chance the trend will continue in the foreseeable future.

While the AD Line is lagging the ASX 200 to the upside, it is performing in a satisfactory manner. This tends to suggest we will not see any new significant lows in the short-term.

Risk Management

Investment Accounts

Hedged against downside risk using the Betashares Australian Equities Strong Bear Complex ETF (BBOZ).

10/04/2025. Bought 10,000 BBOZ at $28.34. Last traded price

Trading Accounts

I remain short the ASX 200. Loss.

I am happy to maintain these positions with the risk-reward profile skewed to the downside. If, by this time next week, a trending move to the downside has not commenced, I will be forced to rethink these positions.

The fox of the Komna Plateau.

Appendix One

The NEoWave Diametric is a corrective price pattern composed of seven segments or waves: four trending or directional waves labelled A, C, E, and G, and three countertrend or nondirectional waves B, D, and F.

Diametrics have two main characteristics: first, they expand during the first four waves and then contract, or the reverse may occur. These variations are illustrated above. Second, five out of the seven waves show significant similarity in duration and complexity.

Price

No Fibonacci relationships exist between adjacent or alternate waves.

The trending waves (A, C, E and G) tend to pair off. Two will be “x” price length while the other two are “y” price length.

Two of the corrective waves (B, D or F) will be similar in price.

Wave G will usually mimic Wave A or be related by 61.8% in price and time.

Time and Complexity

Five of the seven waves tend to be similar in time and complexity.

One of the waves will usually be twice as long in duration as the “similar” waves.

It is uncommon for five consecutive wave segments to have the same duration.

Appendix Two

The NEoWave Flat is a corrective price pattern composed of three segments or waves: two trending or directional waves labelled A and C, and one countertrend or nondirectional wave, B.

Price

Wave A is usually violent relative to the surrounding price action.

Wave B must retrace at least 61.8% of wave A. In a normal Flat, the retracement will be between 61% to 99%. In an Expanded Flat, wave B will retrace between 101% to 130%. In rare instances, it could retrace up to 161% of A.

Wave C will usually be slightly longer than Wave A. It will usually make a lower low unless Wave B is 125% or greater than Wave A.

Time and Complexity

Wave B will likely be 3-5 times longer in duration than Wave A.

If Wave A and Wave B are distinctly different in duration, Wave C should take half of the time of A + B, plus half of the complexity of A + B. If Wave A and Wave B are similar in duration, Wave C will likely be the sum of these two waves.

Lexicon

Corrective price pattern: A reaction against the prevailing trend of one larger degree. Overlapping is a common feature although it is not a strict prerequisite. Corrections are an outgrowth of indecision or ambiguity with respect to the future. They are labelled alphabetically (A-B-C etc).

Elliott Wave Principle: the idea that market behaviour is self-affine in nature due to recurrent oscillations in public opinion across different but simultaneous timeframes. It posits that price action can be defined, quantified and classified, and used to project the future evolution of price.

Impulsive price pattern: A fast-moving market. Impulse waves produce a significant change in the price level. A distinctive feature is minimal or no overlapping, depicting a strong level of conviction about the outlook. They contain five segments labelled numerically (waves 1-2-3-4-5).

NEoWave: Neely Extensions of Elliott Wave. The body of knowledge enunciated by Glenn Neely, represents a significant break or extension of the original theory postulated by Ralph Elliott.

Price behaviour: the qualitative assessment of price action. Essentially, the largest, fastest moves are always in the direction of the prevailing psychological trend.

Wave structure: the quantitative relationship between different waves of price action.

Transmission time:

Sydney: 09-May-2025 16:22

Ljubljana: 09-May-2025 08:22

London: 09-May-2025 07:22

New York: 09-May-2025 02:22

A high-low chart plots the period's highs and lows in the order in which they occur. I only utilise price action between 10:10 and 16:00 when the market is fully open.

Measured from high to low or low to high rather than from the beginning to end of the wave.

25WA signifies Wave-A of the corrective price pattern that commenced in 2025. It is the nomenclature developed by the late great Zoran Gayer

The ASX 200 Equal Weight Index includes the same constituents as the benchmark ASX 200 Index. The latter is a capitalisation-weighted index, while the former gives each company an equal weighting. The Official Close is included in the calculation.

May not be as

Thanks, always interested, with the correction this year as you say is probable but may be as worst thought.

Keep tabs thanks Daniel